7-month Lows in GBPUSD Ahead of BOE Tomorrow

BOE Eyed Next

GBPUSD remains weak today, ahead of tomorrow’s closely watched BOE meeting. The pair has been on a steady slide since the September highs around the 1.37 mark, no trading down at 1.30, marking 7-month lows. A bullish shift in USD over recent weeks accompanied by a weakening of the Pound has seen the pair under sustained selling pressure. Looking ahead this week there is plenty of potential for fresh downside if we see a dovish surprise from the BOE tomorrow.

Weak Inflation in Focus

Rate cut chances for November had been sidelined in recent months. However, a slew of weaker-than-forecast data recently, notably a cooler CPI reading, has seen traders reviving rate cut bets ahead of the meeting. If the bank does keep rates steady tomorrow, guidance is likely to lean on the dovish side, boosting expectations of a December cut, which should keep GBP pressured for now.

Reeves’ Pre-Budget Speech

The impact of Rachel Reeves speech yesterday ahead of the upcoming UK Autumn Budget has been broadly negative for Sterling also. Critics claim that Reeves speech was short on details and investors were left lacking reassurance after the Budget. While Reeves cited the need to tackle high borrowing costs not glimpse was offered into how this might be achieved. As such, GBP remains skewed lower with traders wondering whether the govt will be able to tackle this issue effectively at all.

Technical Views

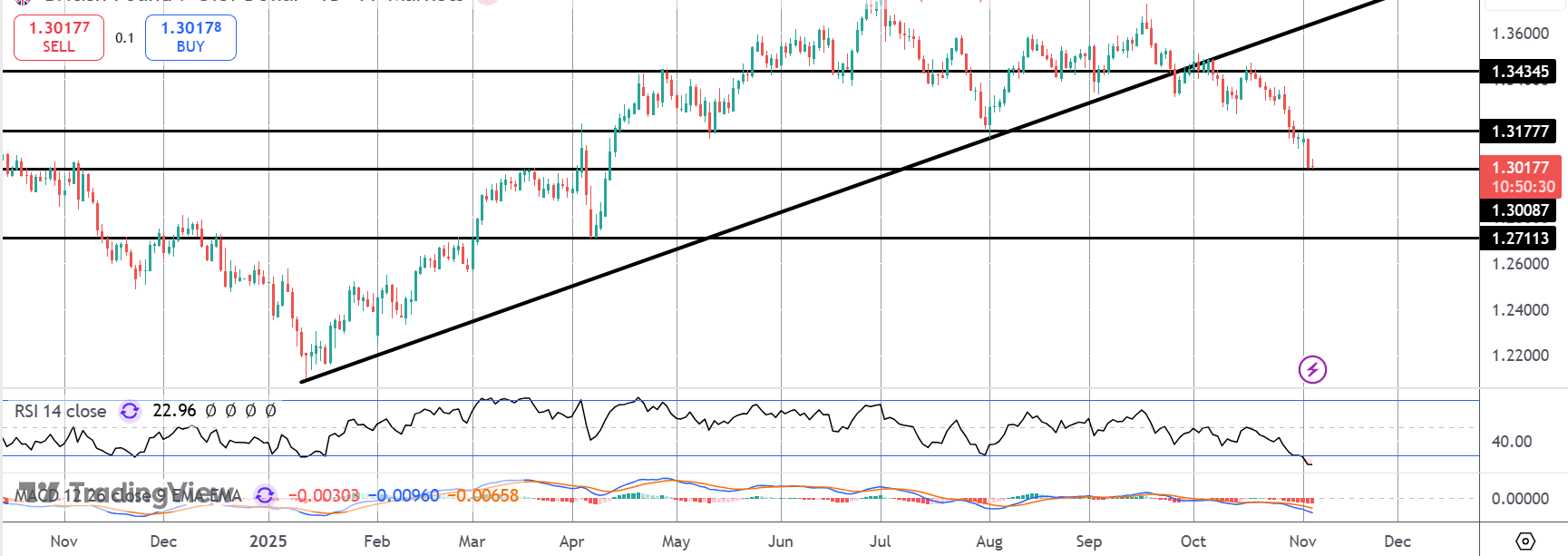

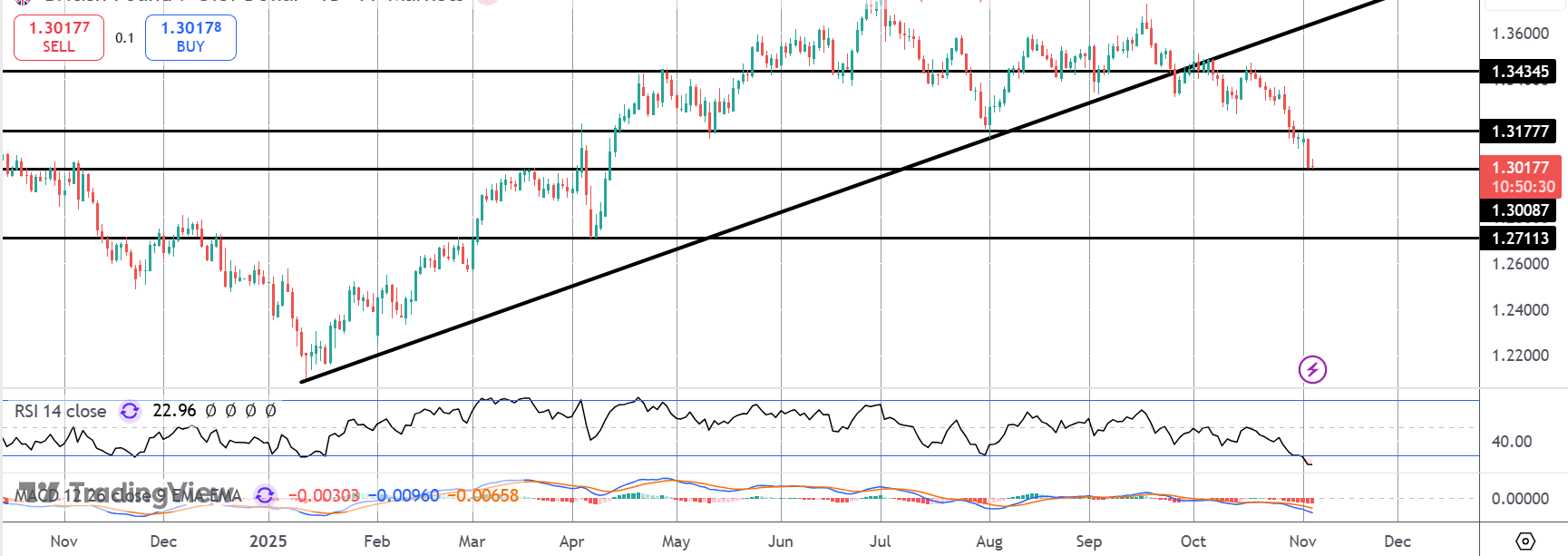

GBPUSD

The break below the bull trend line is gathering pace now with price breaking down below a key ledge of support at the 1.3177 level. While that level remains above as resistance, focus is on a continuation lower. If we break the 1.30 level price is currently testing, focus will turn to 1.2711 next, in line with bearish momentum studies readings.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.