Pound Under Pressure

GBPUSD is reversing hard ahead of the weekend as the latest UK economic data caused concern among investors. The UK budget deficit was seen ballooning last month, with public sector net borrowing hitting £18 billion. This marked the highest level in five years and was well above the £12.7 billion the market was looking for. Over the first five months of the fiscal year, borrowing rose to £83.3 billion, almost £12 billion above the level forecasted in March, while the prior reading was revised higher by £5.9 billion. Coming just ahead of the Autumn Budget, the figure has sparked concern over UK debt levels putting pressure on GBP.

BOE Holds Rates – Cuts QT

Yesterday, the BOE was seen holding rates unchanged at 4% but struck a more cautious tone than some were looking for. Bailey was seen signalling that further rate cuts were still likely though warned that upside inflation risks mean the bank needs to be very careful in making those decisions. Alongside the unchanged rate decision, the bank also announced a scaling back of QT in a bid to minimise the impact on the gilt market. However, the move has been interpreted as a sign of caution over the economic outlook, creating further bearish sentiment in GBP here.

Technical Views

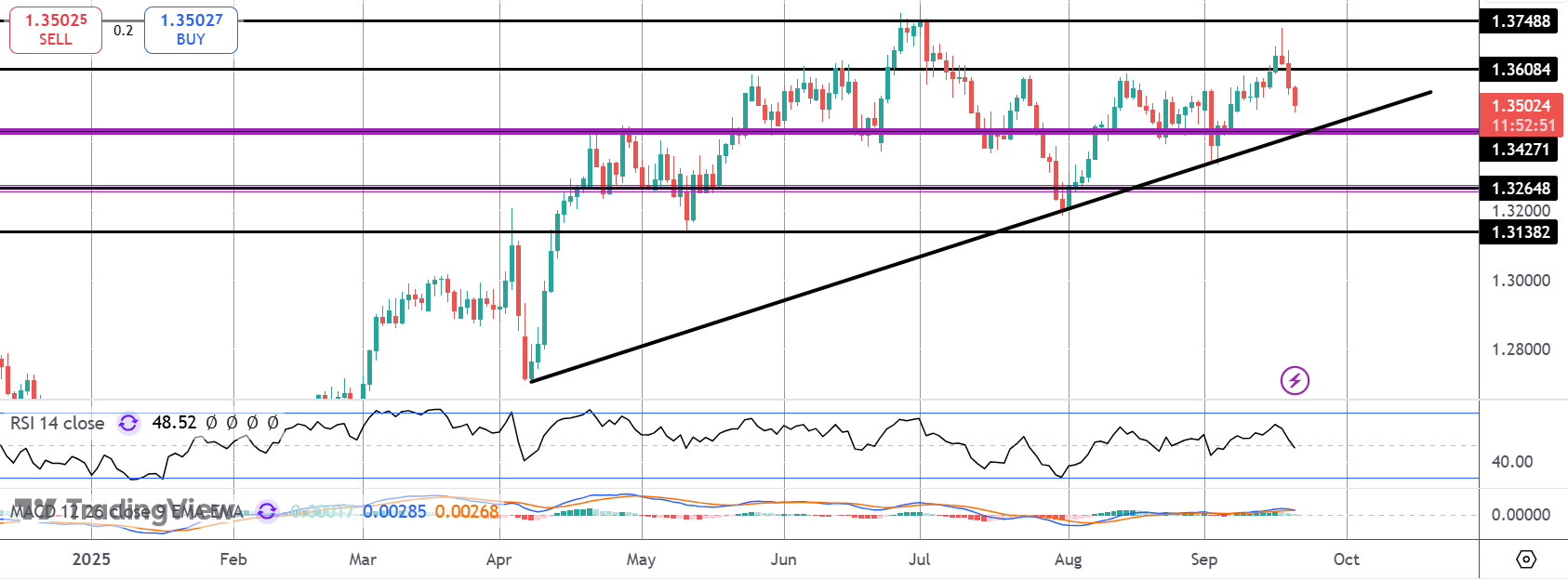

GBPUSD

The failure at the 1.3748 level has seen the market reversing back under 1.36 with price now fast approaching a test of the bull trend line and 1.3427 level. This is a key pivot for the market which bulls need to defend to prevent a deeper shift lower building.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.