Explosive Gold Rally Continues Ahead of FOMC

Gold Hits New Record Highs

Gold prices remain on watch this week with the futures market continuing to soar into fresh record highs. Price is now above the $5k level for the first time and shows no signs of slowing down as a firmly weaker USD and ongoing geopolitical uncertainty keep demand stoked. USD has been heavily lower on the back of Friday’s Fed rate-check activity in USDJPY, fuelling speculation of a possible joint intervention from the BOJ and Fed. With Yen spiking higher and USD plunging accordingly, gold remains an attractive destination play for those looking to store capital against the ongoing geopolitical uncertainty around Russia/Ukraine, US/Iran risks, the US/EU Greenland dispute and rising discontent with ICE activity in the US. With these factors set to remain a key threat to markets near-term, gold prices look likely to continue higher.

Fed On Watch

Looking ahead this week, focus will be on the FOMC meeting midweek. While the Fed is not expected to move rates, traders will be looking for clues as to whether a March cut is still on the table. With pricing for a March cut currently around just 15%, there is plenty of room for a fresh push lower in USD in response to any dovish repricing we see this week, creating support for a higher push in gold. If the Fed downplays rate-cut expectations, however, this could cap the rally in gold for now, allowing USD to recover some ground.

Technical Views

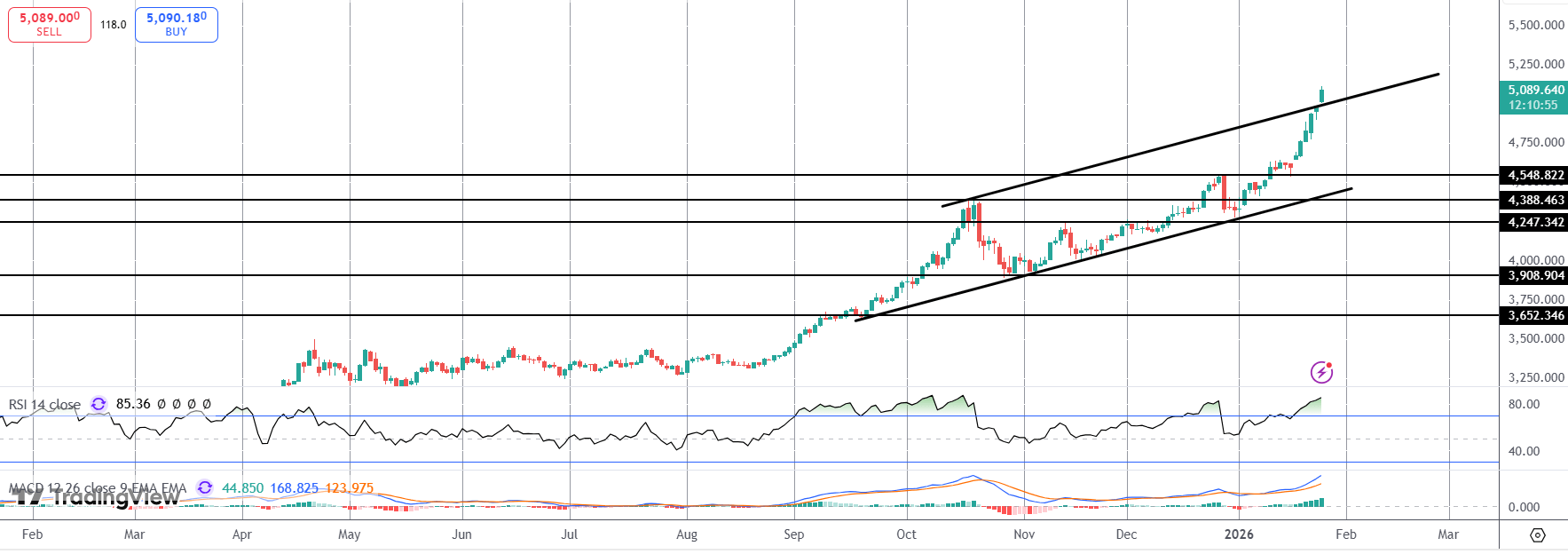

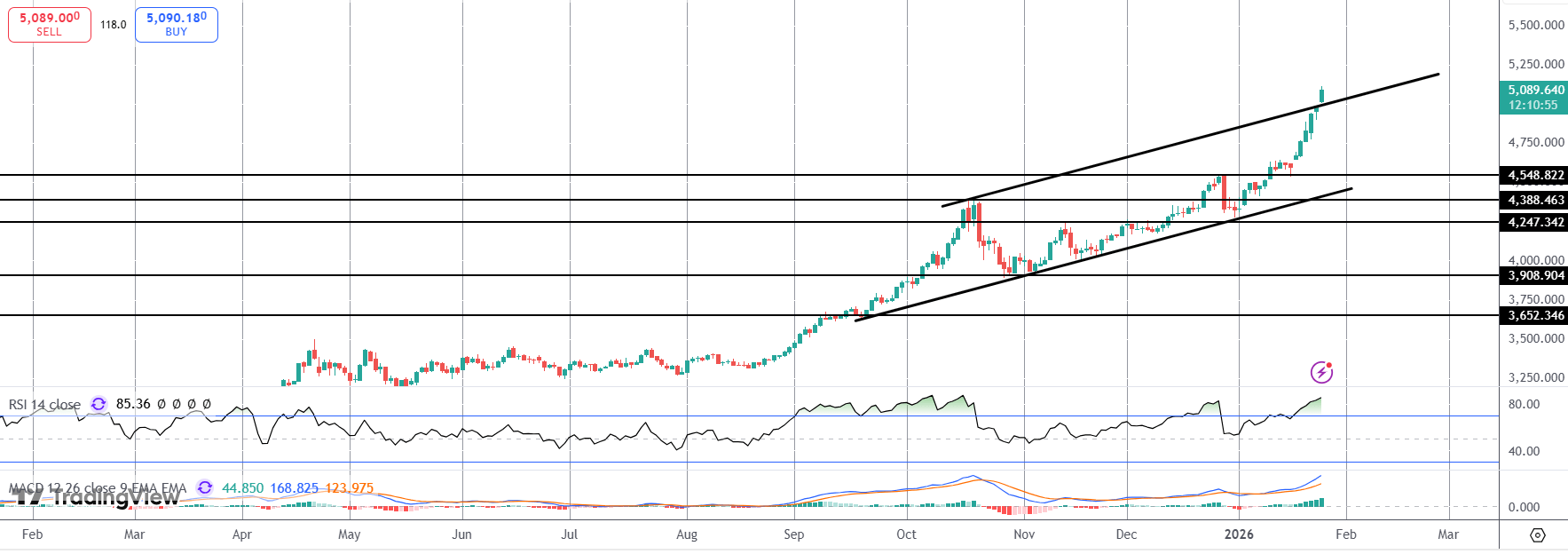

Gold

The rally in gold has seen the market breaking out above the $5k level and above the bull channel highs. With momentum studies bullish focus is on a continuation higher with 5,250 the next big handle or bulls to target. To the downside, key support is now back at the 4,548 level and focus remains on further upside (medium-term) while price holds above this level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.