Institutional Insights: JPMorgan Delta One - Flows, Positioning & CTA Signals

Delta-One Flows & Positioning

US equities near key CTA signals; robust ETF inflows across asset classes, with record-breaking Emerging Markets (EM) inflows and notable style/sector rotations.

Overview

This report examines global futures and US-listed ETF flow and positioning metrics.

Weekly Highlights

Futures Flows

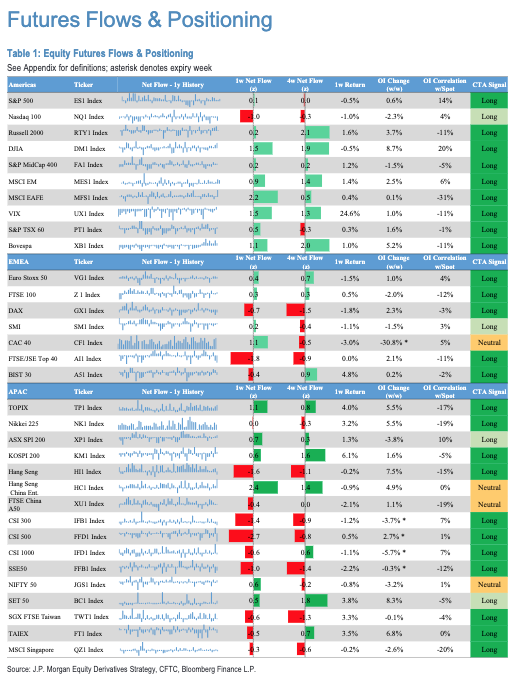

- Significant net buying (>1.5z): Dow Jones, MSCI EAFE, HSCEI, UST Long & Ultra Bond futures.

- Notable net selling (<-1.5z): FTSE/JSE Top 40, Hang Seng, CSI 500, Japan 10Y, SOFR, SONIA, and Heating Oil futures.

- US large-cap equities are trading within ~1-2% of critical short-term CTA signals following the weekend selloff. CTAs likely sold US rates and bought energy week-over-week (w/w). They remain broadly long on global equities, generally short on global rates, and long on metals.

CFTC Positioning

- Asset Managers: Reduced US equity futures, implemented rate steepeners (bought 30Y vs. sold 2-10Y USTs), and hold near-record short positions in VIX futures (-3.3z).

- Leveraged Funds: Increased short positions in ES futures; sold long-end and bought front-end US rates.

- Managed Money: Bought Oil and Gold futures but sold Soybeans and Corn w/w.

ETF Flows

- Total Inflows: $31Bn (1z) into Equities, $16.8Bn (2.3z) into Fixed Income, $4.5Bn (2z) into Commodities, and $2.4Bn (0.7z) into Currency/Multi-asset ETFs.

- Regional Trends: Record inflows (4z) into EM equities, with ~4z into Korea and Brazil/Latam. Strong inflows into International DM ($7.3Bn, 1.1z) and Japan/Developed Asia (~2z). US equities saw slightly above-average inflows ($16.2Bn, 0.3z).

Equity Styles & Sectors

- Style Rotations: Shift from Value (-2z) to Growth (1.3z). Thematic, Managed Risk, and Call/Put Writing funds recorded ~1z inflows.

- Sector Flows: Large inflows into Staples (3.1z), Financials (2.9z), and Energy (2.5z). Outflows (~1z) from Tech and Real Estate.

Fixed Income ETFs

- Strong inflows (~2-3z): Aggregate, Medium-Term Treasury, International, and Municipal bonds. Rotation from High Yield (-1.5z) to Investment Grade (1.2z).

Commodities

- Broad-based inflows: Precious Metals ($3.7Bn, 1.6z, led by GLD), Energy ($0.5Bn, 3.1z), and Base Metals (4.9z).

Crypto ETFs

- Recorded strongest weekly inflows in 3 months: $2.1Bn (0.7z).

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!