Dollar Treading Water Ahead of Fed

USD Hanging On… For Now

The US Dollar is turning lower again today after stabilising yesterday on the back of Friday’s plunge lower. The drop on Friday, which extended into a gap lower yesterday, was fuelled by speculation of potential joint US/Japanese intervention after the Fed conducted a rate-check among US banks in USDJPY on Friday. This came on the back of the BOJ meeting earlier in the day where authorities were suspected of intervening given the sharp drop lower. While no moves have bene confirmed yet, USD remain heavily lower from last week’s highs and vulnerable to further downside this week if we get any dovish cues from the Fed.

FOMC In Focus

Looking ahead this week, focus will be on the FOMC meeting tomorrow which should prove make or break for USD at this stage. With no rate-change expected, focus will be firmly on the accompanying statement and guidance offered. Recent data has leaned towards the positive side, raising the risks of amore neutral tone from the Fed tomorrow which should help underpin USD. Any hawkish comments, more firmly pushing back against the need for near-term easing could see USD rallying as shorts cover. With pricing for a March cut currently around just 15%, there is room for a dovish repricing if we hear any dovishness from the Fed tomorrow, with USD to sell off again if seen. However, this appears more unlikely at this stage and USD should remain supported on the back of the meeting.

Technical Views

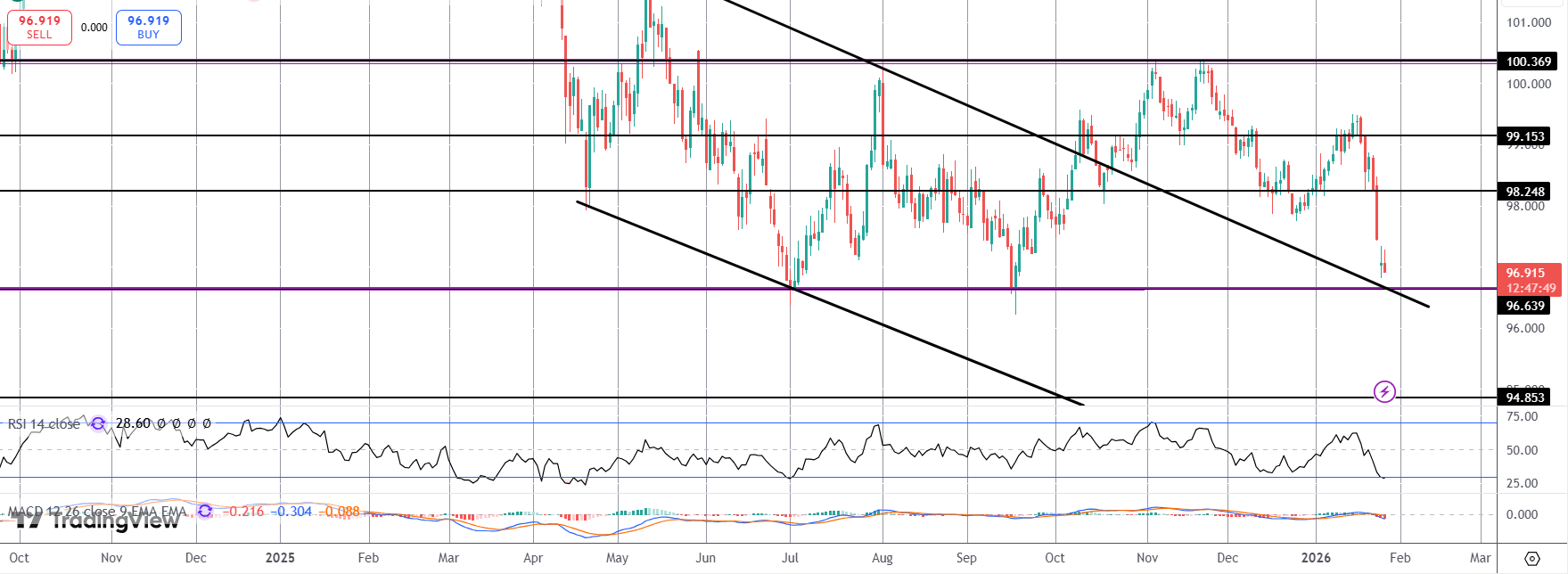

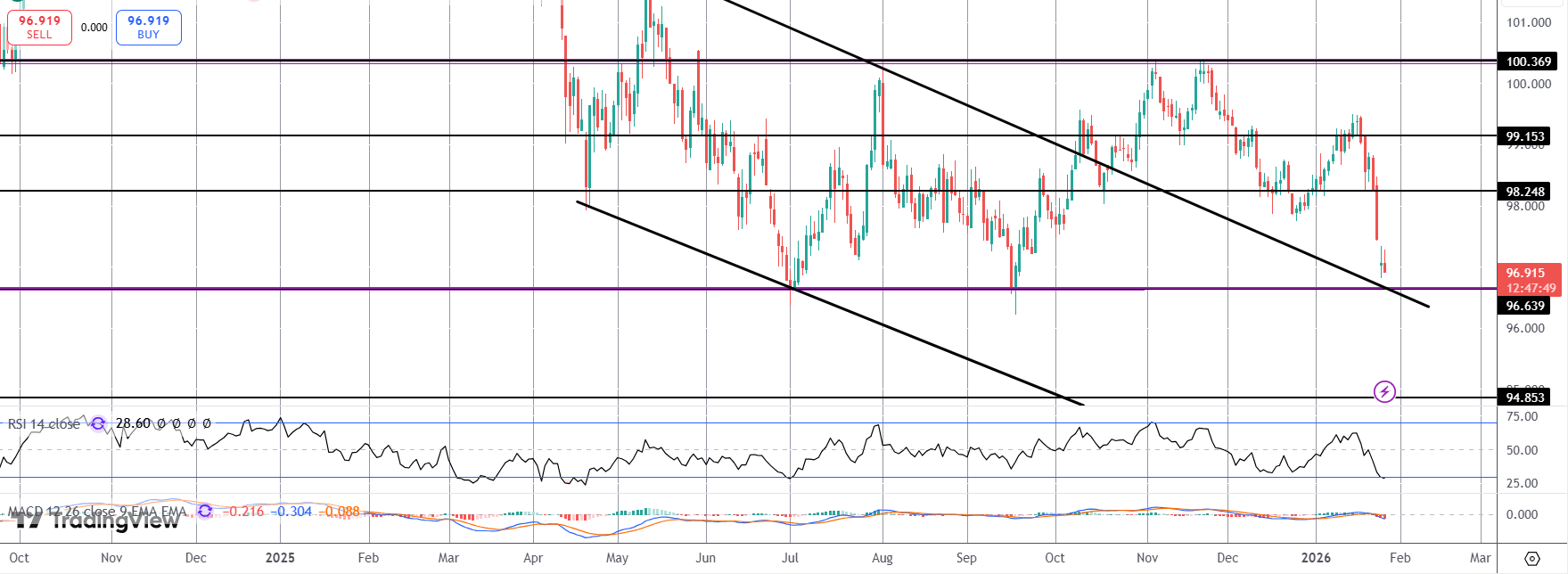

DXY

For now, DXY remains at a key support level, retesting the broken bear channel highs and the 2025 lows around 96.63. While this area holds, a rotation higher back up towards 98.24 can emerge. If we break below, however, focus turns to deeper support at the 94.85 level next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.