Institutional FX Insights: Societe Generale FX View 'Weaker Dollar, Lower Rates'

Buy NOK, SEK, AUD, JPY. Sell EUR, GBP, USD?

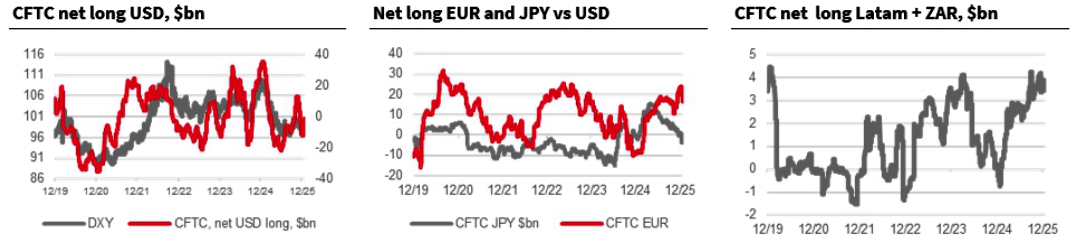

The US and Japanese authorities intervened in the USD/JPY market on Friday evening, triggering heightened volatility. This resulted in a sharp appreciation of the JPY and KRW, alongside another surge in gold prices, now exceeding $5,000. According to CFTC data, the market had recently shifted from a long yen position to short, but this morning’s movements likely erased those short positions. So, what’s next?

The US government, under President Trump and Treasury Secretary Scott Bessent, has been vocal about its preference for a weaker US dollar. While purchasing power parity (PPP) for USD/JPY is below 100, PPP is notoriously unreliable for forecasting but could still irritate US policymakers. From the US perspective, North Asian currencies exhibit significant undervaluation and sustain substantial trade surpluses with the US. However, Japan faces its own challenges, including mounting government debt and stagnant economic growth. A stable yen, rather than a major rally, would be far more desirable for Japan—and the same goes for South Korea. While the current volatility is intense and ongoing, we don’t foresee a sustained downtrend in USD/JPY, as it could have severe economic repercussions.

This development coincided with BlackRock’s Rick Rieder emerging as the leading candidate for the next Federal Reserve Chair, according to betting markets. Rieder is considered supportive of easier Fed policies, which aligns with the broader push for a weaker dollar. We will closely watch the upcoming FOMC meeting, but the strength of the US economy will largely determine the dollar's trajectory. Despite the administration’s preference for lower rates and a weaker dollar, factors like a resilient economy, robust equity markets, and 2.6% core CPI inflation pose significant hurdles. By mid-February, we should have a clearer sense of direction.

Currently, we remain bearish on EUR/JPY and GBP/AUD. A slight downside miss in Germany’s IFO index doesn’t change much, as we only anticipate 1% GDP growth for the eurozone this year—insufficient to justify further EUR gains. Similarly, the UK’s projected sub-1% growth contrasts sharply with Australia’s forecast of above 2%, which brings to mind the recent Ashes cricket series. We also maintain a positive outlook on NOK and SEK, which are likely to benefit from continued dovish rhetoric from the US.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!