Institutionl Insights: Goldman Sachs SP500 Gamma Wall

Goldman Sachs Chart of the Day: Gamma Wall

“It feels like SPX keeps failing at SPX 7,000…”

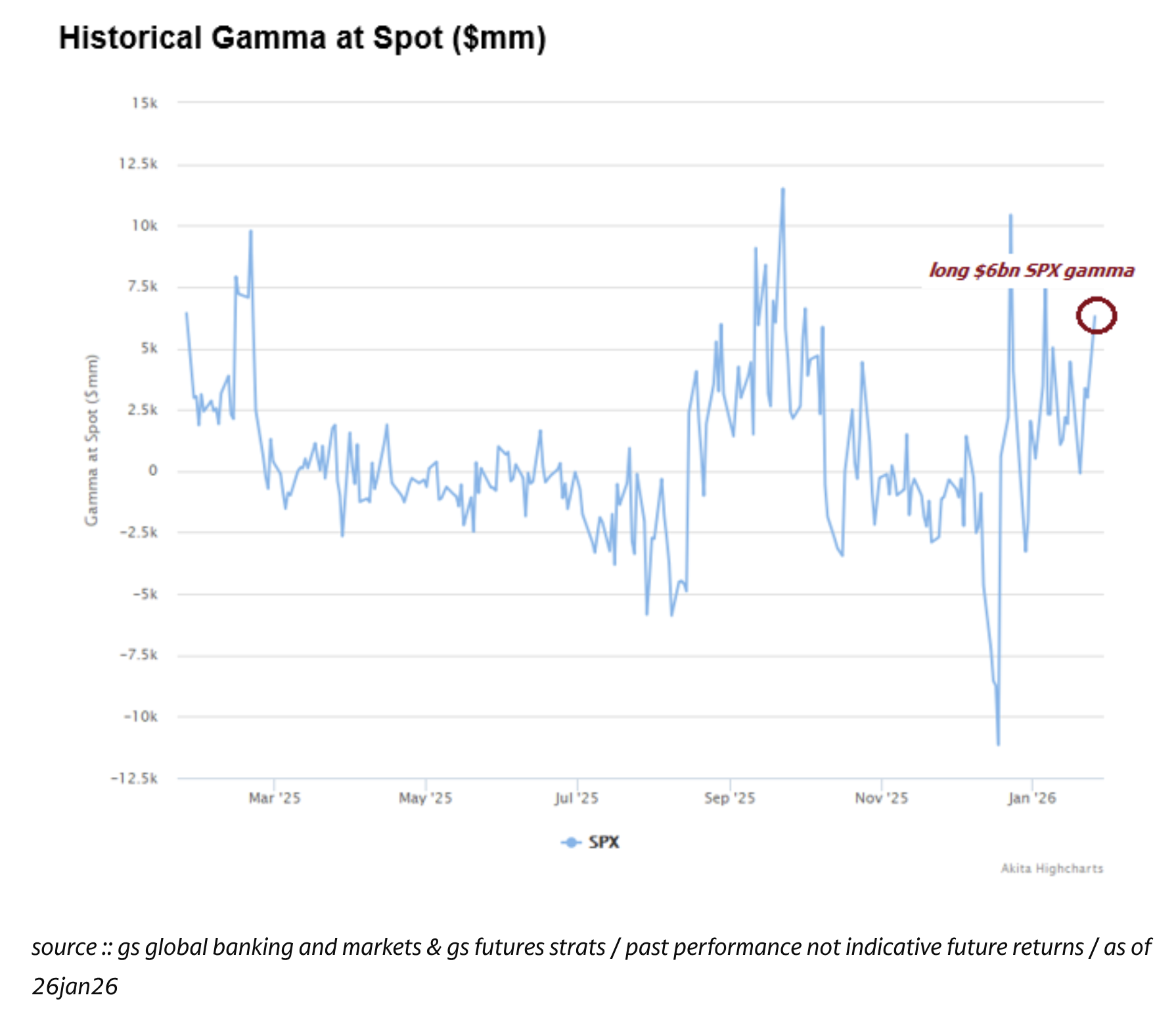

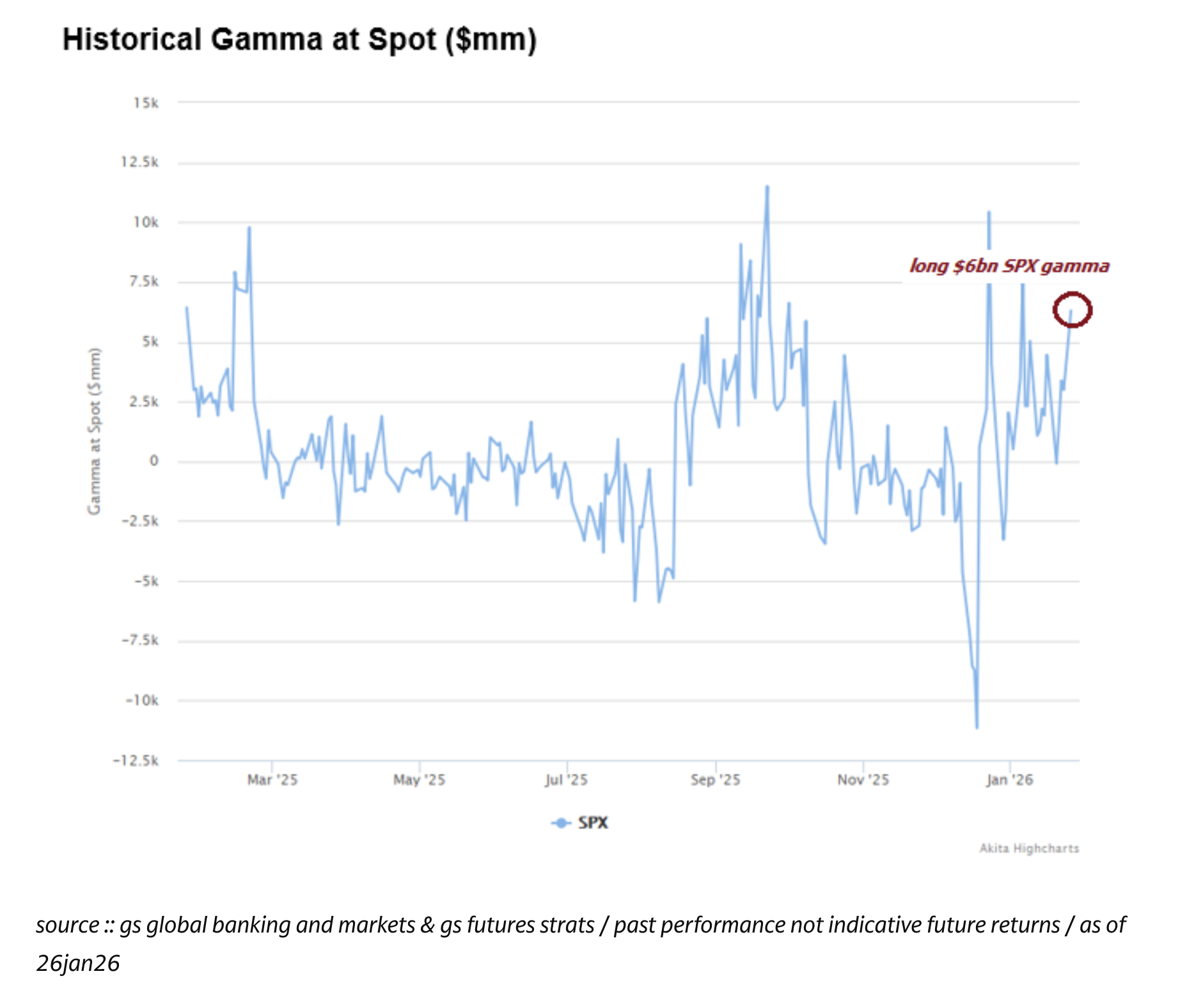

One reason for this is the extreme SPX gamma positioning by market makers. Goldman Sachs futures strategists estimate $6 billion of long gamma at spot, which increases to $12 billion of long gamma if SPX moves 100bps higher.

In simpler terms, a 100bps rally in SPX cash triggers market makers to supply approximately 35,000 e-minis.

According to the GS volatility desk, the 7,000 strike represents the peak concentration of gamma. Beyond this level, while the market doesn’t necessarily “flip short,” the dynamics become significantly cleaner.

To capitalize on a potential upside breakout, the cost of a 2-week SPX 102.5 call is currently trading at historic lows (link).

If a fundamental catalyst is required to push through the 7,000 level, this week’s megacap earnings could provide the necessary momentum.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!